Why Company Formation Offshore Is Important for Global Organization Development and Success

Offshore Company Formation plays a crucial duty in the round of worldwide business development. It supplies different advantages, consisting of positive tax obligation frameworks and regulative settings that urge development. Firms can improve their market accessibility while all at once alleviating threats via diversification. However, the complexities of guiding offshore procedures call for cautious tactical considerations. Comprehending these aspects is vital for businesses aiming to profit from worldwide chances and accomplish continual success. What factors genuinely drive this crucial choice?

Comprehending Offshore Company Formation

Comprehending overseas Company Formation is essential for businesses seeking to broaden their procedures internationally. This process entails developing a lawful entity in a foreign jurisdiction, often identified by favorable regulatory atmospheres. The primary motivations for firms to seek this course consist of enhanced personal privacy, possession defense, and operational adaptability. By registering an overseas firm, businesses can access brand-new markets and get an affordable side.

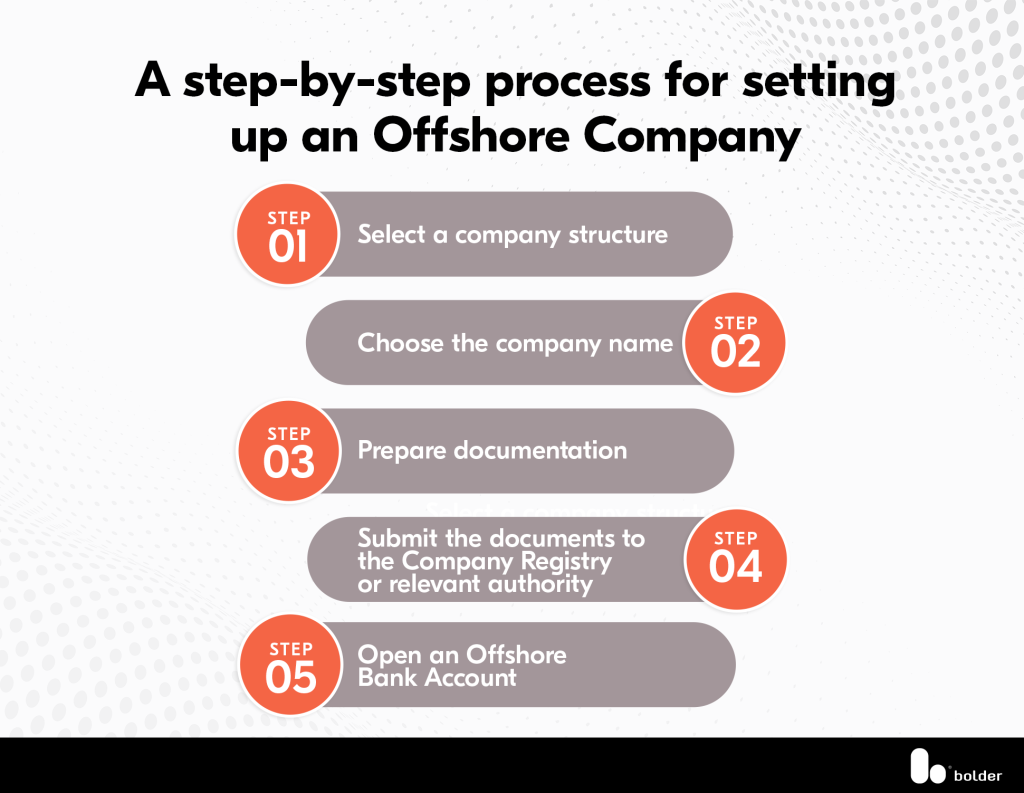

The formation process normally consists of picking a territory, preparing necessary paperwork, and adhering to regional regulations. Jurisdictions vary in their needs, with some offering streamlined treatments to draw in foreign capitalists. It is vital for companies to perform extensive study to pick a suitable place that aligns with their operational objectives. Additionally, involving with monetary and lawful experts can aid in maneuvering the complexities connected with offshore policies and assure conformity. Eventually, recognizing the subtleties of overseas Company Formation is important for successful international company endeavors.

Benefits of Positive Tax Obligation Frameworks

The facility of offshore firms usually supplies substantial benefits with beneficial tax obligation frameworks. Reduced tax obligation responsibilities can boost earnings retention, permitting organizations to reinvest sources much more properly. This critical technique not only enhances economic efficiency but also placements firms for sustainable growth in an affordable global market.

Minimized Tax Obligation Responsibilities

While steering through the complexities of global organization development, many business owners transform to offshore Company Formation to maximize minimized tax obligation responsibilities. Offshore territories typically supply eye-catching tax obligation incentives, including reduced or zero corporate tax prices, which can substantially reduce total tax obligation commitments. This economic advantage enables business to assign resources more efficiently, making it possible for reinvestment in development initiatives and boosting competitive positioning. In addition, the simplicity of compliance in particular overseas locations enhances the tax procedure, lowering management worries. By strategically picking territories with positive tax structures, businesses can enhance their economic techniques, inevitably resulting in raised productivity. Consequently, reduced tax obligation liabilities end up being a powerful device for business owners seeking to expand their worldwide reach while making best use of financial performance.

Improved Revenue Retention

Offshore Company Formation not only promotes lowered tax obligation liabilities however likewise greatly boosts revenue retention. By developing a business in jurisdictions with beneficial tax obligation structures, business can keep a larger part of their profits. These offshore entities usually take advantage of lower corporate tax obligation rates and different rewards designed to attract foreign investment. Such settings enable organizations to reinvest profits better, driving innovation and development. Additionally, the potential for asset security even more urges firms to maintain profits offshore, shielding them from domestic tax rises or financial instability. This critical technique to benefit monitoring encourages businesses to designate resources in ways that advertise development, ultimately adding to lasting success in a progressively affordable international market.

Governing Settings That Advertise Growth

Regulatory environments substantially affect the development capacity of services seeking development beyond their domestic markets. Countries that execute adaptable governing frameworks often bring in international financial investment and facilitate smoother operations for worldwide companies. These atmospheres usually feature streamlined procedures for business registration, decreased governmental hurdles, and positive tax obligation regimens, which jointly boost functional performance. Additionally, encouraging regulations can urge advancement and entrepreneurship by giving legal structures that secure intellectual property and advertise fair competitors.

In regions where regulations are constantly updated to show international market fads, companies can adapt quicker to transforming business landscapes. This flexibility permits companies to take advantage of emerging chances and mitigate risks connected with international expansion. Ultimately, the visibility of a favorable governing environment is an essential variable in a business's ability to prosper and maintain development in the competitive worldwide industry, enabling them to properly leverage their sources and strategies.

Enhancing Market Access and Client Base

Just how can organizations properly improve their market accessibility and broaden their customer base in a global landscape? Offshore Company Formation acts as a calculated tool in this regard. By establishing a presence in crucial worldwide markets, organizations can browse neighborhood regulations more easily, thereby boosting their reach. This method enables customized advertising and marketing strategies that resonate with diverse customer preferences, inevitably cultivating brand name loyalty.

Additionally, overseas firms can take advantage of favorable tax obligation programs and reduced operational costs, causing affordable prices. Partnerships with regional partners can even more enhance market penetration, offering beneficial insights right into regional fads and consumer behavior. Leveraging innovation, such as e-commerce systems, can also facilitate access to a more comprehensive audience.

Basically, developing an overseas company can greatly increase an organization's capability to take advantage of new markets and grow its customer base, positioning it for lasting success in an international economic situation.

Risk Reduction Via Diversification

Diversity can take the type of different item lines or solutions, which can secure against industry-specific recessions. Firms that run throughout several markets can much better hold up against modifications in customer need and financial shifts.

Enhancing Operations and Minimizing Expenses

Streamlining operations and minimizing expenses are vital top priorities for organizations looking for to enhance efficiency and earnings in today's competitive landscape. Offshore Company Formation uses different advantages that facilitate these objectives. By operating in territories with lower tax obligation prices and minimized regulative worries, business can substantially reduce their overhead expenditures.

Additionally, contracting out particular features to offshore locations permits companies to leverage specialized abilities and lower labor costs, which can cause enhanced functional efficiency. This critical method allows firms to focus on core proficiencies while preserving adaptability in source allotment.

Furthermore, streamlined supply chain monitoring through global collaborations can lower delivery expenses and lead times, even more boosting functional performance. As companies broaden worldwide, taking on an offshore structure can cause maximized processes and cost-efficient services, ultimately driving continual growth and success in the international marketplace.

Strategic Considerations for Successful Offshore Ventures

Strategic considerations are important for the success of overseas endeavors - company formation offshore. An extensive evaluation of the legal framework, exploration of prospective tax obligation advantages, and the growth of reliable market access techniques can substantially influence end results. Comprehending these components allows services to navigate intricacies and maximize their global development initiatives

Lawful Structure Analysis

While traversing the intricacies of offshore Company Formation, comprehending the lawful framework is essential for making certain compliance and making the most of advantages. A comprehensive evaluation of jurisdictional policies, corporate find out here administration requirements, and reporting commitments is essential for any business thinking about overseas expansion. Firms must browse different lawful environments, which typically consist of different laws regarding possession, liability, and functional techniques. Additionally, recognizing the effects of worldwide treaties and agreements can substantially affect critical decisions. Engaging regional lawful experts can aid minimize risks related to regulatory conformity and enhance the overall authenticity of the offshore entity. Eventually, a robust lawful framework not just safeguards the offshore venture but also fosters reputation and depend on with stakeholders, helping with smoother procedures in the global industry.

Tax Obligation Advantages Expedition

Exactly how can organizations leverage tax obligation benefits through overseas Company Formation to enhance their international operations? By establishing firms in jurisdictions with beneficial tax obligation routines, companies can significantly minimize their tax obligation liabilities. Offshore entities usually profit from lower company tax rates, exemptions on funding gains, and reduced tax on foreign income. Additionally, lots of overseas centers offer legal frameworks that promote tax efficiency, such as dual tax treaties that secure against excessive taxes in several jurisdictions. This strategic positioning permits companies to reinvest financial savings into growth initiatives. Additionally, services can make use of offshore frameworks for asset security and wide range management, ensuring long-term sustainability while going across complicated international tax landscapes. Such benefits make overseas Company Formation a critical consideration for international business development.

Market Entry Approaches

Leveraging tax obligation benefits with offshore Company Formation can greatly enhance a service's worldwide procedures, yet successful market entrance also requires cautious planning and implementation. Companies have to perform detailed market research to determine target demographics and consumer choices. Picking the best access setting-- whether with joint endeavors, collaborations, or straight financial investments-- can considerably impact long-lasting success. In addition, comprehending local laws and compliance requirements is important to stay clear of legal pitfalls. Crafting a tailored advertising strategy that reverberates with the local audience will certainly assist in building brand name recognition. Furthermore, developing solid connections with neighborhood stakeholders can help with smoother Click Here procedures. Eventually, a distinct market entry strategy, aligned with business's total goals, is critical for optimizing the benefits of overseas Company Formation.

Regularly Asked Questions

Exactly how Do I Select the Right Offshore Jurisdiction for My Business?

Choosing the ideal overseas territory calls for examining aspects such as tax obligation advantages, regulative setting, political security, legal framework, and convenience of operating. Examining these standards aids guarantee the jurisdiction aligns with the company's critical objectives.

What Are the First Prices of Setting up an Offshore Business?

The initial costs of establishing up an overseas business can differ substantially, usually ranging from legal fees, registration costs, and conformity costs. Factors such as jurisdiction and organization kind additionally affect general expenses.

Can I Keep Control Over My Offshore Workflow From My Home Nation?

Lots of individuals can preserve control over overseas procedures from their home nation through different communication modern technologies and monitoring strategies. Local laws and time zone distinctions may pose obstacles that need careful navigation and planning.

What Are the Common Misconceptions Regarding Offshore Company Formation?

Usual misconceptions regarding offshore Company Formation include the idea that it is entirely for tax evasion, that it assures privacy, which it is only appropriate for huge corporations, instead of easily accessible to local business too.

How Do I Make Sure Conformity With International Regulations and Laws?

To assure conformity with international regulations and policies, one must perform thorough research study, speak with lawful specialists, preserve clear documents, and stay upgraded on regulative changes appropriate to the specific territories and industries included.

Offshore Company Formation plays a crucial role in the ball of worldwide organization expansion. While steering via the intricacies of global company growth, several entrepreneurs turn to offshore Company Formation to exploit on minimized tax liabilities. Offshore Company Formation likewise supplies economic and lawful benefits, such as favorable tax regimes and governing environments, which can further support businesses from potential dangers. Just how can services take advantage of tax obligation advantages with offshore Company Formation to boost their global procedures? Leveraging tax obligation advantages via overseas Company Formation can significantly boost an organization's worldwide operations, yet successful market entrance additionally requires mindful planning and execution.